what is the income tax rate in dallas texas

Texas does not have an individual income tax. The Dallas County sales tax rate is.

Texas Income Tax Calculator Smartasset

100 rows Dallas County is a county located in the US.

. Multifamily Tax Subsidy Project Income Limits. Dallas County is ranked 167th of the 3143 counties for property taxes as a percentage of median income. 7500 50 - 69 Disability.

Collin Dallas Denton Ellis Hunt Kaufman and Rockwall. The minimum combined 2022 sales tax rate for Dallas Texas is. The Dallas TX HUD Metro FMR Area consists of the following counties.

Ad Compare Your 2022 Tax Bracket vs. 2022 Tax Rates Estimated 2021 Tax Rates. Discover Helpful Information and Resources on Taxes From AARP.

10000 2020 AD VALOREM TAX RATES FOR DALLAS COUNTY. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must collect from their customers.

The current total local sales tax rate in Dallas TX is 8250. Sales Tax State Local Sales Tax on Food. The Dallas sales tax rate is.

The Texas Franchise Tax. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of. States With The Highest And Lowest Property Taxes Social Studies.

12000 30 - 49 Disability. It is the second-most populous county in Texas and the ninth-most populous in the United States. The December 2020 total local sales tax rate was also 8250.

Your average tax rate is 1198 and your marginal tax rate is. The 2018 United States Supreme Court decision in South Dakota v. The following table provides the most common 2017 total combined property tax rates for 177 Dallas Fort Worth area cities and towns.

The average yearly property tax paid by Dallas County residents amounts to about 43 of their yearly income. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Highland Park which has a combined total rate of 167 percent has the lowest property tax rate in the DFW area and Hawk Cove with a combined rate of 317 percent has the highest tax rate.

What is the sales tax rate in Dallas Texas. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Sales Tax State Local Sales Tax on Food.

Texas does not have a corporate income tax but does levy a gross receipts tax. If you make 70000 a year living in the region of Texas USA you will be taxed 8387. SCHOOL DISTRICTS 70 -100 Disability.

What is the local sales tax rate in Texas. The Texas state sales tax rate is currently. Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 820 percent.

Excess exemption value reported is a local jurisdiction option. We dont make judgments or prescribe specific policies. The minimum combined 2022 sales tax rate for Dallas County Texas is.

See what makes us different. DC College District. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

The rate increases to 075 for other non-exempt businesses. The state of Texas collects 625 on purchases and the City collects another 2 for a total of 825. As of the 2010 census the population was 2368139.

Depending on local municipalities the total tax rate can be as high as 825. Texass tax system ranks 14th overall on our 2022 State Business Tax Climate Index. There is no applicable county tax.

Both Texas tax brackets and the associated tax rates have not been changed since at least 2001. Contact Mariner Wealth Advisors for assistance in making this transition. For tax rates in other cities see Texas sales taxes by city and county.

Real property tax on median home. The other one percent is used for General Fund services. Notice of Tax Rates Form 50-212 Tax Rate and Budget Information Tax Code 2618 For more information related to Dallas County tax rates please visit the Dallas County Tax Office website.

The HUD definition. Your 2021 Tax Bracket to See Whats Been Adjusted. 1 2 3 4 State mandated exemption is 10000.

Sunday June 19 2022. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. To see the change in sales tax revenue over time check out Sales Tax History below.

One percent of what the City collects goes to Dallas Area Rapid Transit or DART. Texas has no state-level income taxes although the Federal income tax still applies to income earned by Texas residents. Truth in Taxation Summary.

Ad Download our checklist to learn about establishing a domicile in a tax-advantaged state. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023. 2021 Tax Year Rates.

You can print a 825 sales tax table here. This is the total of state county and city sales tax rates. The County sales tax rate is.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. This is the total of state and county sales tax rates. What is the income tax rate in dallas texas.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Texas Income Tax Rate 2022 - 2023. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

You can use the Texas property tax map to the left to compare Dallas Countys property tax to other counties in Texas. Texas state income tax rate table for the 2022 - 2023 filing season has zero income tax brackets with a TX tax rate of 0 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The state sales tax rate in Texas TX is currently 625.

HUD literature refers to the 80 of AMFI standard as low income and the 50 standard as very low income. Real property tax on median home. What is the sales tax rate in Dallas County.

2020 HUD Income Limits. Texas Is Income Tax Free Texas is one of seven states with no personal income tax. Did South Dakota v.

The Texas sales tax rate is currently. Wayfair Inc affect Texas.

Businesses Likely To Get Advance Tax Reduction Irs Taxes Tax Debt Tax Reduction

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Texas Busy Practice Just Outside Of Dallas Seeking A Dermatologist High Earning Potential Forney Tx Texas Jobs Dermatology Job

91st Birthday For Him 91st Birthday Decoration 91st Birthday Etsy Birthday For Him Birthday Poster 80th Birthday Gifts

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Bobby M Collins Education Annuities Specialist In Dallas Fort Worth North Texas Retirement Particularly In North Texas And The Da In 2022 Annuity Retirement Collins

Texas Income Tax Calculator Smartasset

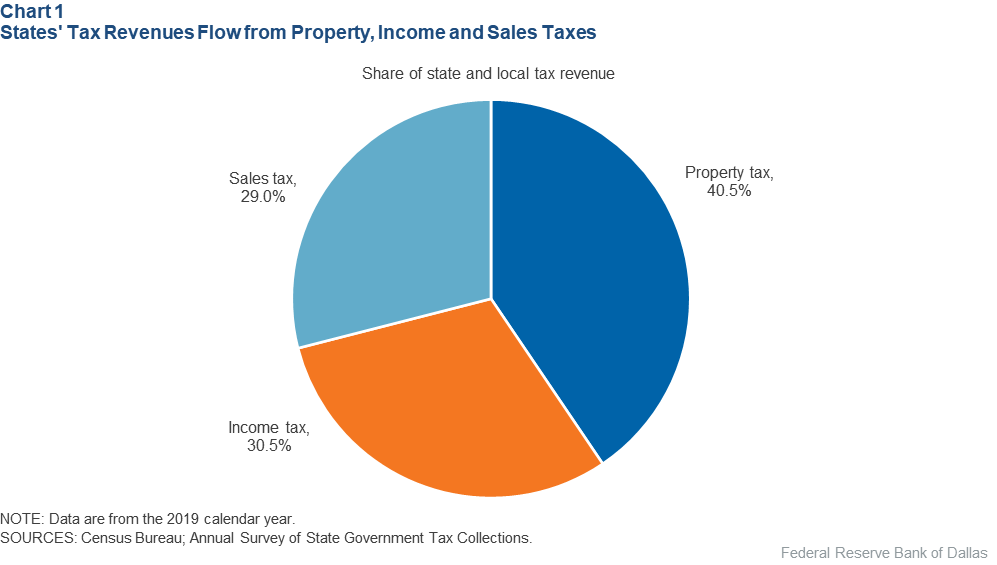

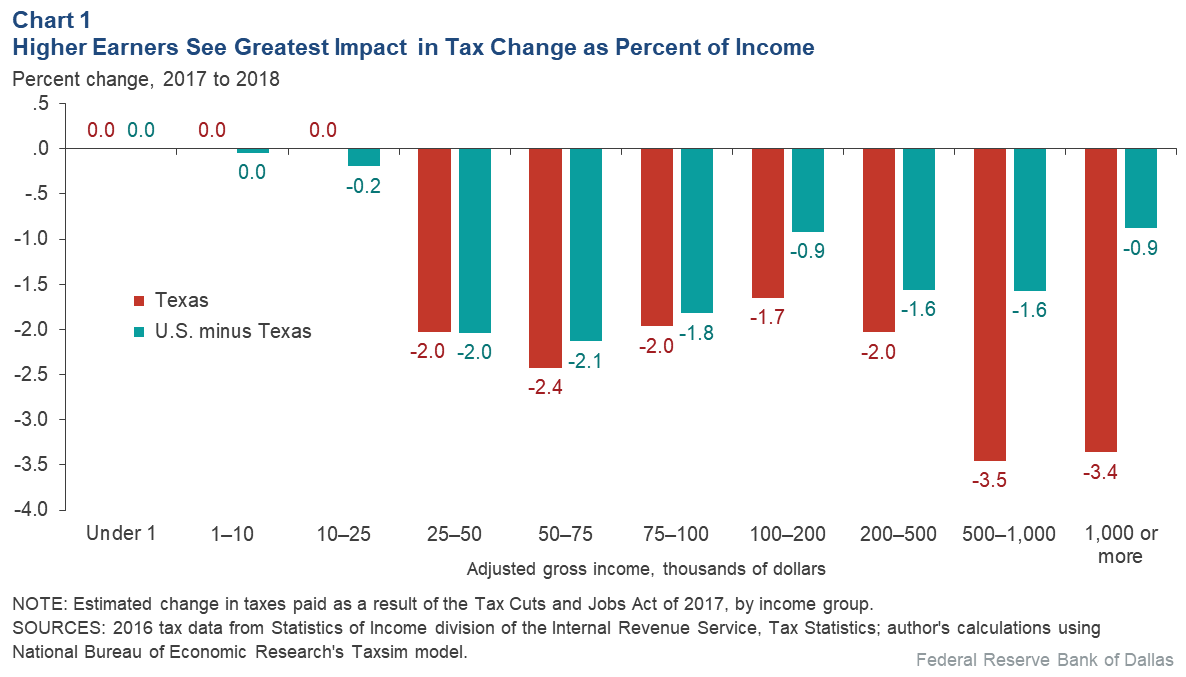

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

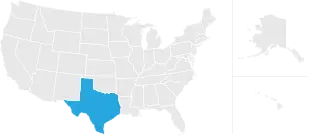

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Bookkeeping Business Plan Template Google Docs Word Apple Pages Template Net In 2022 Bookkeeping Business Business Launch How To Plan

Texas Income Tax Calculator Smartasset

Where Do My Taxes Go H R Block Consumer Math Business Leader Financial Planning

States Like Texas With No Income Tax Not Always More Affordable Study Says Dallas Business Journal